How to Apply SSS Calamity Loan 2020 Online?

Before sending the application online, here are the eligibility requirements.

- Must be registered in the SSS website (My.SSS facility) to facilitate filing of online application.

- Must have at least thirty-six (36) monthly contributions, six (6) of which should be posted within the last twelve (12) months prior to the month of filing of application.

- Must be residents of the Philippines. A resident, for the purpose of CLAP, is one who has a home or work address within the Philippines.

- Have not been granted any final benefit, i.e. total permanent disability or retirement.

- Must not have an outstanding Loan Restructuring Program (LRP) or Calamity Loan Assistance Program (CLAP)

Steps in Submitting Online Application to Avail SSS Calamity Loan

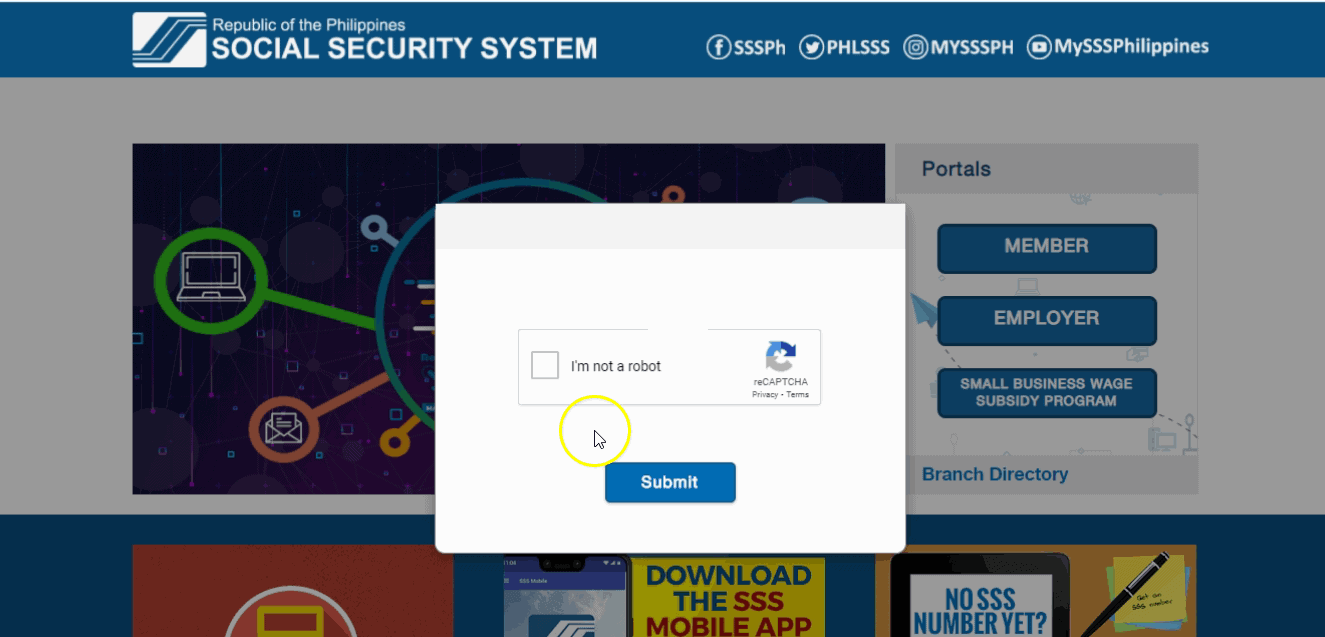

- Go to SSS official website.

- Prove you are not a robot by selecting the correct images that are being asked.

- Select the “Member” button.

- Enter your username and password.

- From the dashboard, go to E-SERVICES menu, then select Apply for Calamity Loan.

- Make sure that the contact information with SSS is updated. If not, update first your mailing address, mobile number, landline number and email address under the MEMBER INFO menu. If updated, proceed with the next step.

- Select the loanable amount you wish to avail.

- Choose the bank account where you want the loan proceeds will be deposited by SSS. If you have not added yet your bank account, add it under the E-SERVICES then select Disbursement Account Enrollment Module. You may add your PESONet account number or your SSS issued UBP Quick Card.

- Tick the box to agree with the Terms and Conditions for Calamity Loan and will be followed by the Disclosure statement.

- Finally, click the “Proceed” button and Submit button to certify the agreement and promissory note.

Watch This Complete Video on How to Apply SSS Calamity Loan Online

Submitting SSS calamity loan applications online can be done in no more than 10 minutes!

Coverage of the Program

Members who are residents of the entire Philippines affected by the strict community quarantine to manage the Corona Virus Disease 2019 (CoViD-19) situation, in pursuance to Proclamation No. 929 by the President of the Philippines dated 16 March 2020 declaring a State of Calamity throughout the Philippines due to CoViD19.

SSS Calamity Loan Assistance Program Terms and Conditions

Availment Period

The availment period shall start on 15 June 2020 until 14 September 2020.

Service Fee

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

Other Conditions

- The member must apply for the Calamity Loan Assistance Program thru the SSS website by accessing his/her My.SSS account.

- The member’s home or work address as reflected in the SSS database must be within the Philippines.

- This calamity loan must be fully paid before the member can avail of future calamity loans of SSS.

- Any overpayment on a previous loan shall be subject to validation of SSS, and if valid, shall be applied to the active loan, if any. If there is no active loan, it shall be refunded to the member-borrower upon his/her request.

- If release thru checks: Calamity loan check shall be sent to the member’s preferred mailing address.

- If with activated UMID-ATM, the loan proceeds shall automatically be credited to member’s account.

- If release thru UBP Quick Cards: The loan proceeds shall be credited to member-borrower’s account within three (3) to five (5) working days from approval date of the loan. Member-borrowers may avail of

UBP Quick Cards at UBP Kiosks located at selected 26 SSS Branches. - If release thru PESONet accredited banks (once available and implemented in the system): The loan proceeds shall be credited to member-borrower’s account within one (1) to two (2) working days from

approval date of the loan - Other terms and conditions in the existing salary loan guidelines not inconsistent with the above provisions shall be applicable in this program.

Disclosure Statement on Loan / Credit Transaction

The disclosure statement is available if you are qualified. In the statement, it includes the approved loan amount, service fee of 1%, net proceeds, and schedule of payments.

In my application submitted on September 14, 2020, the first payment will be due three(3) months later which will be on March 31, 2021.

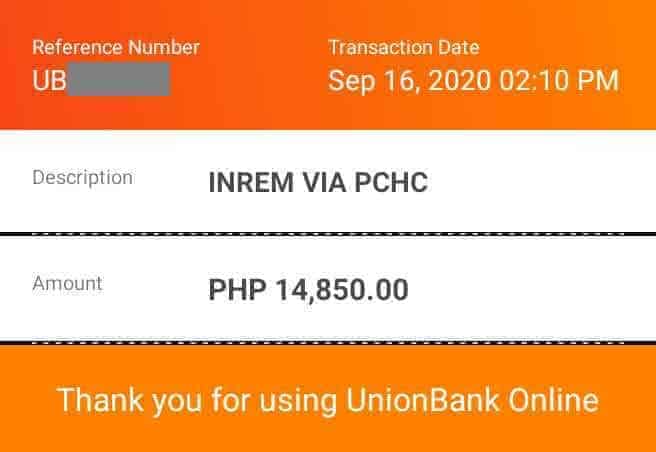

Loan Proceeds

According to SSS, the loan proceeds shall be credited to member borrower’s account within three (3) to five (5) working days from the approval date of the loan. But I am so impressed as to how fast the loan proceeds came into my UnionBank account in just 2 (two) days! I applied to avail of the SSS calamity loan on Sept 14, 2020 and I received the loan proceeds 2 days after on September 16, 2020.