Welcome to the world of elevated financial experiences with the Metrobank Titanium Mastercard. Look no further if you’re looking for a credit card that seamlessly combines style and substance. In this review, we’ll delve into the features and benefits that make this card stand out from the crowd, helping you make an informed decision about your next financial companion.

Picture this: a sleek, metallic credit card that not only feels premium in your hands but also adds a touch of sophistication to your wallet. The Metrobank Titanium Mastercard is not just a piece of plastic; it’s a statement of your refined taste. With its titanium core, this card is as durable as it is stylish, ensuring it stands the test of time in both appearance and functionality.

Generous Rewards Program

One of the key highlights of the Metrobank Titanium Mastercard is its generous rewards program. Earn points with every swipe and watch as your everyday purchases translate into exciting rewards. Whether it’s travel, shopping, or dining, this card opens the door to a world of possibilities. The more you use it, the more you’ll discover the perks waiting for you.

Double the Rewards, Double the Delight

One standout feature of the Metrobank Titanium Mastercard is the double rewards points program. Elevate your shopping and dining experiences as you earn double rewards points with every transaction. Whether you’re indulging in a gourmet meal, updating your wardrobe, or making online purchases, each swipe brings you closer to exciting rewards. You can earn 1 point for every PHP 20 spent, with the added benefit of earning 2x Rewards Points on dining, department store, and online transactions.

Bonus Points on Select Transactions

The Metrobank Titanium Mastercard rewards you with 2x points on specific transactions to sweeten the deal. Enjoy double the points when you engage in online shopping, department store purchases, and dining transactions. This targeted approach to bonus points ensures that you maximize your rewards in the areas that matter most to you.

Limited-Time Offer: No Annual Fees

For new cardholders with the foresight to apply between January 1, 2023, and February 29, 2024, the Metrobank Titanium Mastercard brings an exclusive offer – no annual fees. This limited-time promotion allows you to enjoy all the premium benefits of the card without the burden of annual fees, making it the ideal time to make the Metrobank Titanium Mastercard your financial companion.

Without the offer, the Metrobank Titanium Mastercard’s annual fee is PHP 2,500 for the principal cardholder and PHP 1,500 for the supplementary cardholder.

Never-Expiring Points System

Unlike some credit cards that impose expiry dates on accumulated points, the Metrobank Titanium Mastercard offers a never-expiring point system. For every PHP 20 spent, you earn one point that stays with you indefinitely. This feature ensures that your efforts to accumulate points are not rushed, allowing you to redeem rewards at your own pace.

How to Maximize Your Rewards

- Strategic Spending: Leverage the 2x points on online, department store, and dining transactions by aligning your spending habits with these categories.

- Take Advantage of the Limited-Time Offer: If you’re considering applying for the Metrobank Titanium Mastercard, seize the opportunity to do so between January 1, 2023, and February 29, 2024, to enjoy the privilege of zero annual fees.

- Savor Every Transaction: With the never-expiring points system, there’s no rush to redeem your rewards. Accumulate points at your own pace and redeem them for the rewards that truly enhance your lifestyle.

The Metrobank Titanium Mastercard isn’t just a credit card; it’s a gateway to a world of perks and privileges. From double rewards points and a limited-time no annual fee offer to a never-expiring points system and bonus points on select transactions, this credit card is designed to enhance every aspect of your financial journey.

Metrobank Titanium Mastercard Credit Limit

The credit limit for the Metrobank Titanium Mastercard varies based on individual creditworthiness and financial standing. Credit limits are determined by the bank, considering factors such as income, credit history, and other financial obligations. Keep in mind that maintaining good credit behavior may contribute to potential credit limit increases over time.

A credit limit is the maximum amount of money that a credit card issuer, such as a bank or financial institution, allows a cardholder to borrow on a credit card. It represents the cap on the total outstanding balance the cardholder can accumulate. Several factors influence the determination of an individual’s credit limit:

- Creditworthiness: The primary factor considered is the cardholder’s creditworthiness, which is assessed based on credit reports, credit scores, and overall credit history. A higher credit score and positive credit history generally result in a higher credit limit.

- Income: Card issuers often consider the applicant’s income to assess their ability to repay credit card balances. A higher income may lead to a higher credit limit.

- Debt-to-Income Ratio: Lenders may also evaluate the debt-to-income ratio, comparing the individual’s monthly debt payments to their gross monthly income. A lower ratio may result in a higher credit limit.

- Employment and Stability: A stable employment history and financial stability contribute positively to the credit limit determination. Lenders prefer applicants with a steady income source.

- Existing Credit Lines: The individual’s current credit utilization and the limits on existing credit lines may influence the decision. Lower utilization rates and responsible credit management can be favorable.

It’s important for cardholders to be aware of your credit limits and to use credit responsibly. Exceeding the credit limit may result in fees, declined transactions, and potential damage to one’s credit score. Regularly monitoring credit card statements, managing balances, and staying within the credit limit contribute to a positive credit history and financial well-being. If you wish to request a credit limit increase, you can contact Metrobank to discuss the possibility based on your financial circumstances and credit history.

Metrobank Titanium Mastercard Cash Advance

Cash2Go is essentially a cash loan or cash advance feature available to qualified Metrobank credit cardholders. It allows cardholders to convert a portion of their available credit limit into cash, providing them with immediate funds that can be used for various purposes.

Key features of Metrobank Cash2Go:

- Quick and Convenient: Metrobank credit cardholders can avail themselves of Cash2Go easily and quickly. The process typically involves a simple application, and once approved, the cash is credited to the cardholder’s account.

- Flexible Repayment Terms: The cash amount converted through Cash2Go is usually repayable in fixed monthly installments. Cardholders may have the flexibility to choose the repayment terms that suit their financial situation.

- Interest Rates and Fees: While Cash2Go provides quick access to cash, it’s important for cardholders to be aware of the applicable interest rates and fees. Cash advances often come with higher interest rates than regular credit card transactions.

- Accessible Funds: The cash obtained through Cash2Go can be used for various purposes, such as paying bills, covering emergency expenses, or making purchases where cash is required.

It’s crucial to check the specific terms and conditions of Metrobank Cash2Go, including interest rates, fees, and repayment terms, as these details may vary. Additionally, since financial products and services can be updated or modified over time, I recommend checking with Metrobank directly or visiting their official website for the most recent and accurate information about Cash2Go or any other services they offer.

Metrobank Titanium Mastercard Fees and Interest

Interest Rates: The retail monthly interest rate is 3%, and the cash advance monthly interest rate is also 3%, calculated from the date of the cash advance being availed.

Minimum Amount Due: Cardholders are required to pay either PHP 850 or 3% of the outstanding balance, depending on which is higher.

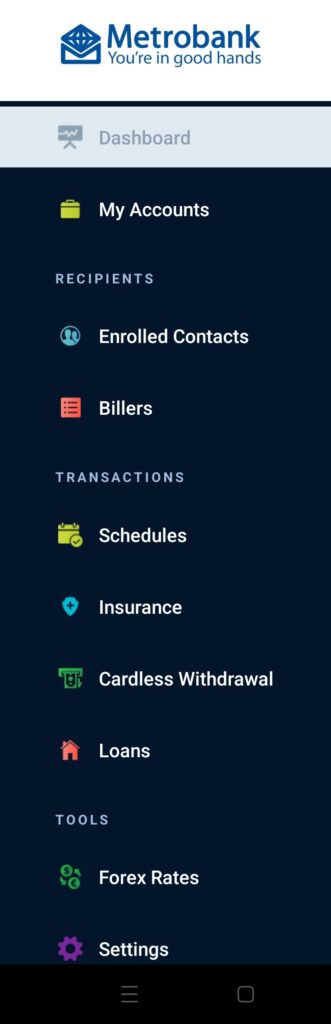

The Metrobank App: Your Financial Companion

Stay in control of your spending with the Metrobank Mobile App. Monitor your transactions, check your balance, and even set spending limits—all at your fingertips. The app enhances your overall Metrobank Titanium Mastercard experience, providing convenience and accessibility wherever you go.

Metrobank Titanium Mastercard Eligibility Criteria and Application Requirements

Before you embark on the journey of acquiring the Metrobank Titanium Mastercard, it’s essential to understand the eligibility criteria and the basic requirements for a seamless application process.

1. Eligibility Criteria

To be eligible for the Metrobank Titanium Mastercard, you must meet the following criteria:

- Age Range: Applicants should be between 18 to 70 years old.

- Minimum Annual Income: A minimum annual income of PHP 350,000 is required to qualify for this starter credit card.

- Employment Status: Prospective cardholders should have at least 6 months of continuous employment as a regular employee or be a principal cardholder with another bank.

Meeting these criteria ensures that the Metrobank Titanium Mastercard is extended to financially stable individuals with a consistent credit history.

2. Basic Credit Card Requirements

To streamline your application process, make sure you have the following documents and information ready:

- Valid TIN, SSS, or GSIS Number: The Tax Identification Number (TIN) or Social Security System (SSS) or Government Service Insurance System (GSIS) number is a prerequisite for the application. Ensure that the provided number is accurate and up to date.

- Active Business or Residence Landline Number: Metrobank requires applicants to have a verifiable landline number either at their residence or business. This helps establish a reliable point of contact during the application process.

- Active Mobile Number: A valid and active mobile number is crucial for communication and updates regarding your application status. Ensure that your mobile number is accessible and in working order throughout the application process.

By fulfilling these basic credit card requirements, you contribute to a smoother application process and increase the likelihood of your application being processed promptly.

Applying for the Metrobank Titanium Mastercard

Now that you meet the eligibility criteria and have the necessary documents in hand, applying for the Metrobank Titanium Mastercard is a straightforward process. You can visit the official Metrobank website or a nearby branch to initiate your application.

Steps to Apply:

- Visit the Metrobank Website: Navigate to the official Metrobank website to access the online application form.

- Fill in the Required Information: Complete the application form with accurate personal and financial details.

- Attach Necessary Documents: Upload scanned copies of the required documents, including proof of income and identification.

- Wait for Approval: Once submitted, your application will undergo a review process. You will be notified of the status of your application in due course.

- Receive Your Metrobank Titanium Mastercard: Upon approval, your Metrobank Titanium Mastercard will be delivered to your registered address.

Final Verdict

The Metrobank Titanium Mastercard is more than just a credit card—it’s a lifestyle upgrade. With its stunning design, lucrative rewards program, travel benefits, security features, and flexible payment options, this card is tailored to meet the needs of the discerning cardholder.

So, if you’re ready to redefine the way you experience financial transactions, consider making the Metrobank Titanium Mastercard your next financial companion. Elevate your lifestyle and enjoy a world of privileges that come with this exceptional piece of financial innovation. Apply now and step into a new era of credit card experiences with Metrobank Titanium Mastercard.